- Bountiful Buzz

- Posts

- 💥 The Market Mood Is Shifting — Quietly

💥 The Market Mood Is Shifting — Quietly

Real Estate Issue #24 - Love winner inside, buyers gaining ground, and the real estate question that raised eyebrows.

Welcome to this week’s Home Sweet Buzz Real Estate Edition!

We’re announcing our ❤️ Love at First Sight winner, breaking down what Davis County’s latest numbers are quietly telling us, and sharing fresh real estate news that matters. Plus, featured homes, a timely Ask a Realtor question, and a

new update from Todd Porter.

Use the links to jump to your favorite section.

If the links don’t work, Click 👉 read online.

In this Issue . . .

🤣 Real Estate LOL

❤️ Love at First Sight? Winner Announced! 🍫

📊 Local Market Snapshot - What Today’s Davis County Numbers Are Quietly Telling Us

Real Estate News: Farmington’s “subordinate lot” idea meets a state ADU push | February Home Hunt: Buyers Have More Leverage

💬 Ask a Realtor:

Question of the week:❓Shane asked - "If we end up going to war with Iran, what would happen to the housing market?"

🎥 New Video Message from our Sponsor - Todd Porter: “Bountiful Food Update: What’s New Right Now”

📣 🐝 The Bountiful Buzz VIP PASS is LIVE — and it’s totally FREE!

💛 Readers Poll - What interests you most when it comes to Real Estate?

For a better reading experience

👇👇👇

❤️ Love at First Sight — Winner Announced!

Thanks to everyone who shared what makes their heart skip a beat when house hunting — we loved your responses! 💕

The winner is… Nicola Nelson! ✨

You’ve won our sweet Valentine’s treat! 🍫 Please reply to this email so we can arrange getting your prize to you.

Stay tuned… we’ve got more fun coming your way in future issues of the

Home Sweet Buzz! 🐝🏡

Brought to byTodd Porter, SURE Synergy United Real Estate Group

❤️🏡 What Today’s Davis County Numbers Are Quietly Telling Us

If you’ve been watching prices in Bountiful and around Davis County and thinking,

“Is the market cooling, shifting, or just… confusing?” — you’re not alone.

Right now, homes across the county are taking about a month and a half to sell on average, with a median of 46 days. That means if your home doesn’t fly off the shelf the first weekend, you’re still right on track.

👉 The panic you see online? Not necessary here.

📊 The Real Story in the Numbers

We’re seeing a clear pattern emerge:

Sellers are starting high… but buyers are winning back negotiation room.

Countywide, original list prices are averaging in the low $600Ks, while the homes that actually close are landing closer to the low $500Ks. That gap is showing up across Bountiful, Centerville, Kaysville, Syracuse and North Salt Lake.

🏚️ Luxury & “Wishful” Listings Are Stacking Up

In higher-end areas like Farmington and Fruit Heights, many active listings are pushing $1M+.

But the homes that are actually selling?

👉 Often closing in the mid-$500Ks or below.

Right now, the mid-price and move-up range is where the real action lives.

⚡ Well-Priced Homes Still Move Fast

In cities like: Kaysville, Layton, North Salt Lake, Bountiful & West Bountiful.

Homes that are priced right are still going under contract in 2–4 weeks.

Those long days-on-market numbers you see?

Most belong to homes that:

Started too high

Or haven’t adjusted yet

💰 Affordability Pockets Still Exist

There are still opportunities — especially for first-time buyers.

Cities like Clearfield and Sunset continue to offer options under $400K, with strong price-x performance. Smaller starter homes may carry a higher price per square foot, but they’re still giving buyers a real path into Davis County.

❤️ Where to Watch the Market’s “Heartbeat”

If you want the clearest pulse of the local market, keep your eye on:

Layton • Syracuse • Bountiful

These cities carry the bulk of the activity, and what happens there tends to ripple across the county.

🐝 From Your Local Buzzkeeper

My goal is simple: help you feel calm and informed — not overwhelmed.

If you want to be the hero of your next move:

1️⃣ Follow Bountiful Buzz for weekly Home Sweet Buzz check-ins

2️⃣ Save this update for your planning notes

3️⃣ Comment with your city, and I’ll break down your neighborhood next

You don’t have to guess what the market is doing.

You can move when it’s right for your life — and feel confident doing it. 💛

“Custom EPIC Report”

If for any reason, property tax concerns, estate planning, wealth evaluation, you are wondering what the present value of your home; scan this QR code or go to https://sureut.com/epicreport and we will promptly provide you with our detailed professionally engineered EPIC Report:

🏡 Farmington’s “subordinate lot” idea meets a state ADU push

Farmington’s Planning Commission agenda (Feb. 5, 2026) includes a subdivision request that uses alternative lot sizes and asks for a Conditional Use for a Subordinate Single-Family Dwelling (SSF) lot as part of the proposed Miller Hollow Subdivision near 350 S / 450 W. (Utah)

At the same time, KUTV reports a state proposal (HB 477) that would require cities to allow an ADU on any lot with a properly permitted single-family home, while still letting cities set design, dimension, and height standards.

Why It Matters: If HB 477 moves forward, Farmington’s approach could become the model (or the minimum) that other South Davis cities may have to follow—changing what “single-family neighborhoods” look like over time.

👉Read More

🏠 February Home Hunt: Buyers Have More Leverage

Utah’s housing market has been tilting more buyer-friendly, with more homes listed than this time last year and sellers/builders offering incentives like closing-cost help and interest-rate buydowns.

That’s timely heading into late February and the spring ramp-up, when more listings typically hit the market and buyers tend to get a wider selection—and more room to negotiate than they’ve had in a while.

Why It Matters: For South Davis County shoppers (Farmington to NSL), February could be a smart window to shop, compare, and negotiate before the busiest spring competition heats up. 👉 Read More

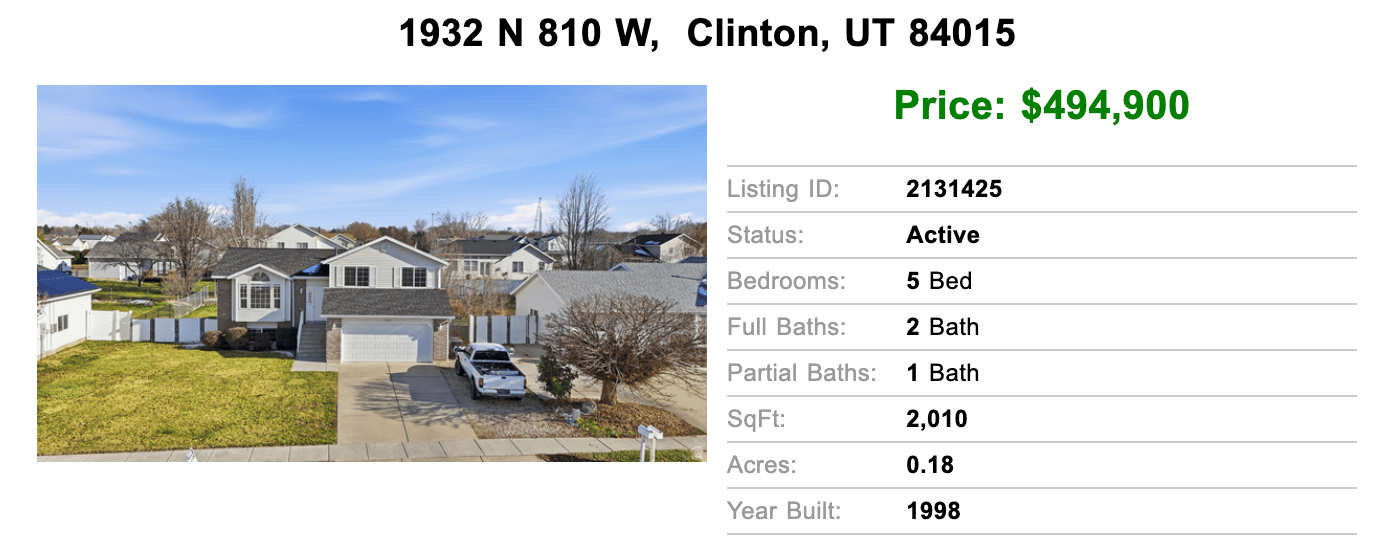

🏡 This Week’s listings & Open Houses

in Davis County

Contact Todd Porter - 801 755 1882 | [email protected]

Contact Todd Porter - 801 755 1882 | [email protected]

Contact Todd Porter - 801 755 1882 | [email protected]

Contact Todd Porter - 801 755 1882 | [email protected]

🏘️Your Weekend Open-House Report

Scan the QR Code below for a complete list of

open houses happening around Davis County.

👇👇👇👇

🔑 ATTENTION ALL REALTORS!!!

🏡 Want Your Listing or Open House Listed Here?

We welcome submissions from ALL local real estate professionals!

👉 👉 Submit your listing here - (Listing must be located within Davis County)

💬 Real Estate Q & A

❓Shane asked:

"If we end up going to war with Iran, what would happen to the housing market?"

🧠 Todd’s Answer:

Great question, especially due to the fact that it is highly likely that the United States is going to strike Iran again.

If we went to war with Iran, most homeowners wouldn’t see bombs. They’d see it at the gas pump first. Iran lies near the Strait of Hormuz, a chokepoint for ~20% of global oil exports.

Picture a family in Utah thinking about listing their home. They’re not watching troop movements. They’re watching oil prices jump overnight. Gas climbs. Groceries creep up. Suddenly inflation isn’t some headline, it’s dinner getting more expensive.

That’s where housing feels it.

When oil spikes, inflation usually follows. And when inflation rises, the Fed doesn’t relax. Mortgage rates either stall or move higher. Buyers who qualified last week might not qualify this week. Payments stretch. Confidence wobbles. Not panic. Just hesitation.

There’s often a strange first reaction too. Investors rush into U.S. bonds for safety, and mortgage rates can dip briefly. For a moment it feels like relief. Then the longer-term math kicks in if energy stays high. Rates firm back up. Buyers slow down. Builders pause projects. Lenders tighten guidelines quietly.

Does that mean a crash? Not necessarily.

U.S. real estate isn’t in the war zone. Homes don’t lose value because of headlines alone. What changes is behavior. Fewer offers. Longer days on market. Negotiations matter more again.

War doesn’t usually break housing here. Inflation and uncertainty can cool it. And cooling is very different from collapse.

Got a Real Estate question?

👉 Submit a question for next week’s edition

Call me at 801-755-1882, and let’s build your

custom plan to win in this market.

“Bountiful Food Update: What’s New Right Now”

👇 Click pic below to hear Todd’s Message!

(Message changes each week!)

⬇️ ⬇️ ⬇️

📱Call/Text: 801-755-1882

📧 Email: [email protected]

Thanks for spending part of your week with the Bountiful Buzz!Stay informed, stay local, and we’ll see you in the next issue. 🏡✨

Have a great weekend!

— Brenda

What interests you most when it comes to real estate?(select all that apply) |

Reply